PIP Eligibility Fraud

PIP claims are usually the first step in the auto claim process. In order to successfully defraud an insurance carrier you must be consistent when providing information. This is why PIP claims are the first line of defense in fraudulent auto claims. PIP is considered the launching board for all fraudulent auto claims. If you have a solid PIP Eligibility Investigation Program you will:

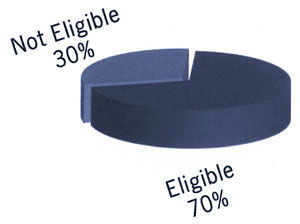

- Determine that 25% to 40% of your claimant’s are not eligible for PIP benefits under yours insured’s policy.

- Identify Underwriting discrepancies. Savings here could be enormous.

- Identify the claimant’s correct Tort Threshold.**

- Identify other accidents the claimant was involved in and policies that afforded coverage

- Identify Diagnostic Facilities/Physical Therapy locations- same treatment on every patient- same diagnosis.

- Identify Essential Services Claims.

PIP Eligibility Investigation Goals

PIP Eligibility Investigation Goals

- Determine WHERE the claimant resided on the DOL

- Determine WHO the claimant resided with on the DOL

- Determine HOW the claimant is related to these people

- Determine IF any relative in the household owned a passenger motor vehicle on the DOL

- Identify the insurance carrier, policy number and effective dates of each policy in the household

Professional Claims Solutions Claims Services’ PIP Eligibility Investigation Program

Through proper vendor/client communication, an effective PIP Eligibility Investigation Program should determine and provide all the evidence needed to deny 20% to 40% of your PIP Claims. When the program first starts the percentages are typically on the higher end of the spectrum.

Assuming your average cost of a PIP Claim is $6,000 (industry standard), then for every 100 claims investigated the hard savings would be anywhere from 120K (20%) to 240K (40%). Your investigative cost is approximately $225 per case on average (3.75%).

- 100 Claims =$600,000 on average in Medical Costs

- 20% to 40% Not Eligible = $120,000 to $240,000

- Investigative Cost (average) = $225.00 = $22,500.00

- For every $1 spent on investigating PIP, you save over $10

Additional Savings:

Underwriting Discrepancies – Over 40% of all PIP Claims investigated have an underwriting discrepancy. The additional premium and/or claims money saved from rescinding the policy is immeasurable!

* * Bl Claims – On many of the claims where we determine the claimant is Not Eligible for PIP benefits, we also find the claimant is subjected to the Verbal Threshold. These savings are enormous!